Get your government contribution

Each year, the government offers an incentive (called a government contribution) towards your KiwiSaver account. This contribution is a small step that could help you get closer to your KiwiSaver goals. So, how can you get the maximum government contribution for KiwiSaver?

What is the government contribution?

This is an annual contribution made by the New Zealand government to eligible KiwiSaver members. You are typically eligible for the government contribution if you:

- are making contributions to your KiwiSaver account,

- live mainly in New Zealand,

- are aged 18 or older; and

- do not qualify for the retirement benefit.

If you would like more information about eligibility, please click here (this link will direct you to more information on the Inland Revenue website).

You could be eligible to receive up to a maximum of $521.43 per year of government contribution. You need to contribute at least $1,042.86 to your KiwiSaver account per year to receive this amount. You can still receive some government contribution even if you cannot contribute this amount. For every dollar you contribute, the government will contribute 50 cents up to a maximum of $521.43 per year. To illustrate what this may look like, see the table below.

| Your personal contributions | Money from government | |

| Weekly | Annual | Annual |

| Over $20 | Over $1,042.86 | $521.43 max |

| $20 | $1,042.86 | $521.43 max |

| $15 | $781.14 | $390.57 |

| $10 | $521.43 | $260.71 |

| $5 | $260.71 | $130.35 |

How do you get the maximum government contribution?

If you are an employee, your contributions will come from your salary. If your contributions from your salary fall short of $1,042.86, then you can make a voluntary contribution towards your KiwiSaver account to receive the maximum government contribution.

If you are self-employed, you can make voluntary contributions towards your KiwiSaver account.

If you want to receive the maximum government contribution, it is essential to know that the government contribution is calculated on a per-year basis (which is measured from 1 July – 30 June). This means you must ensure you have contributed $1,042.86 by 30 June to receive $521.43 in government contributions.

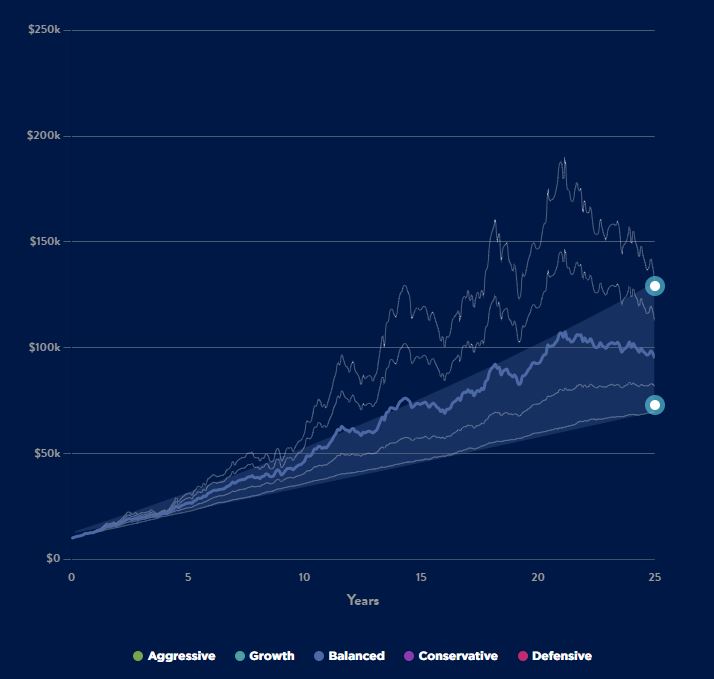

Getting the maximum government contribution is a helpful savings incentive. If you made sure that you received the maximum government contribution each year, you could have received over $5,000 in your KiwiSaver account of free government contributions after ten years (not taking into account any investment returns or losses). The government contribution can help you get closer to reaching your retirement savings goals.