What a quarter! It may be disappointing if your balance has declined with the negative investment returns, however, it should be remembered that the last quarter is just that – one quarter – and that your KiwiSaver account has benefited from an extraordinary run of positive quarters in recent years. In fact, returns for the last 12 months (and longer) across all our funds are positive. Nevertheless, it is timely to assess if your investment portfolio is aligned to your personal situation. We have a useful article on our website that may help you with this if you are unsure.

How did the markets react to Covid-19?

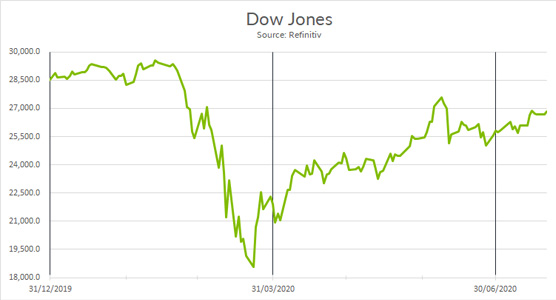

International markets were highly volatile throughout the last quarter due to the impact of Covid-19. As an indication of the large and sudden movements we saw across the last quarter, we have attached the following graph of the Dow Jones index (the commonly referred to USA equity index) which fell 27% from the end of February to late March i.e. in only about three weeks! It then rose by about 30% in the next three weeks. However, this was still about 15% below the December 2019 year-end level (The Dow Jones fell 23% in the quarter). A similar picture to the Dow Jones index has been seen across other markets around the globe.

What has the response been from Governments around the world?

We have seen a number of different responses from Governments around the world ranging from how quickly they reacted to addressing Covid-19 through to the type of level restrictions that they have adopted to fight the virus. Despite the different approaches in how they have handled lockdown restrictions, one thing that is being seen across the board is the large sums of money being spent by governments in an attempt to keep their economies turning over. This has been the case for the New Zealand Government with further announcements still expected.

When can we expect market volatility to stabilise?

Judging by the rebound in shares (at the time of writing April 2020), investors seem to think the worst has passed. It could be said lockdowns are easy to go into but very hard to come out of in terms of economic recovery. We think many uncertainties still remain and that there are probably more questions now than answers, not just with regards to the virus, but concerning the short term and longer-term economic impacts.

This health crisis is also an economic crisis. Will a successful treatment be developed, and when? How long might the lockdowns last? What steps need to be taken to get back to some normality? Will the new normal look different? How will the debt that Governments are taking on be repaid? Answers to these, and many questions, will be very relevant to investment decisions. Nevertheless, judging from history, the global economy will inevitably recover from this crisis.

We are constantly mindful of the environment in which we operate. As had been noted many times in the past within our commentaries, our investment strategy in recent times has been focused first and foremost on protecting your investment. Our experienced in-house investment team was already concerned about high share prices. Your funds will have benefited in the past quarter from this cautious approach.

You can rest assured that we are vigilantly monitoring the situation daily and managing your fund the best we can as we continue to navigate our way through these unique times.

Investment returns at 31 March 2020, before fees and tax:

The table with ID 13 not exists.