Christian KiwiSaver Scheme

Income Fund

Investment objective

The objective for the Income Fund is to achieve modest returns with a low expectancy of capital loss.

Designed for

The Income Fund is designed for investors who are risk-averse and feel uncomfortable investing in a portfolio which invests in growth assets such as property or equities and/or may be close to retirement and consider they may not have time to ride out investments highs and lows.

What it invests in?

This Fund invests only in income assets made up of cash and fixed interest (includes mortgages). It does not invest in equities or other growth assets. Its benchmark asset mix is 100% income assets.

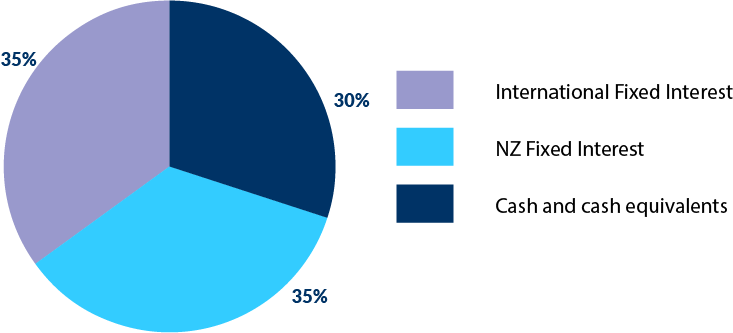

Target Investment Mix

The information on this website shows the target asset allocations for each Fund. The actual allocations may vary from time to time, depending on factors like market movements and changes to underlying asset values. Our objectives may also change from time to time. More information is contained in the Product Disclosure Statement.

Risk level

The value will move up and down, although it is unlikely to fluctuate as much as the Growth Fund and Balanced Fund.

CHRISTIAN VALUES

Christian KiwiSaver Scheme is run by Christians for Christians. Our Scheme is built on universally accepted Christian values.

ETHICAL INVESTING

All our Funds are invested under our Ethical Investment Policy, a policy that is continually evolving as our world changes.

ACTIVE INVESTMENT

We’re committed to active fund management, aiming to provide above-average returns, and generating long-term wealth.

AVERAGE FIVE YEAR RETURN

This Fund has averaged 1.9% returns (before fees and tax) for the five years (p.a.) ending 31 March 2024 (rounded to one decimal place).

Interested in our other funds?

Balanced Fund

This Fund might suit you if you have a medium or longer timeframe to invest and an appetite for a medium degree of risk.

Did you know?

You can invest your savings in any one Fund or a combination of all or any two of the three Funds. The Balanced Fund is the default Fund. If you were auto-enrolled or joined through an opt-in and you do not select a Fund then your savings will be invested in the Balanced Fund.

Are you already a member?

If you are already a member you can change your Fund selection at any time. You will need to send us a completed change of investment choice form either by email or post.

You can join the Scheme in a few steps